Optimizing Entry & Exit

Optimize trade entry and exit to maximize profits by learning the techniques to time your trades effectively for better results.

Introduction

Trading in the dynamic and fast-paced world of financial markets requires a well-structured strategy.

This post introduces key considerations for successful trading, emphasizing the importance of timing, optimal trading locations, strategic trade setups etc.

It delves into identifying high-probability trade locations based on TradeLean Strategy, ensuring traders enter and exit positions with precision.

Whether you are trading long or short, understanding the nuances of market trends and avoiding common pitfalls is crucial for maintaining a disciplined and profitable trading approach.

By integrating these insights into your trading plan, you can enhance your decision-making process and achieve better trading outcomes.

General Considerations

Trading Timing

When trading Crypto or Forex, the Asian session is pivotal as it often sets the tone for the rest of the day, with significant breakouts or pullbacks occurring.

The London session is typically volatile, providing numerous trading opportunities due to the high volume and market activity.

The first four hours of the New York trading session can be exceptionally volatile, but it is advisable to refrain from opening new positions after this period until the daily close to avoid unnecessary risks.

Best Trading Locations

Your risk level should be carefully calibrated based on the distance to your target and the specific trade location.

Do not risk more than 1% of the capital in any trade!

Optimal trading locations are major levels (or zones) on the daily chart, identified through key technical levels that hold significant value: Range Top, Range Bottom, Key Price Levels.

Aim to enter trades as close as possible to the TradeLean Price Levels, as even a few pips of advantage can significantly impact the R:R ratio, especially in scalping strategies where precision is paramount.

According to TradeLean Strategy, all trades are categorised as follows:

"A+ Trades": Trend following rejection trades entered from zones around Key Level 1↓ and Key Level 1↑. They offer the most attractive R:R ratio and are considered as highest probability trades.

"A Trades": Trend following rejection trades from Range Bottom or Range Top. They still offer an attractive R:R ratio and are also considered as high probability trades.

"B Trades": Breakout trades entered upon a breakout of zones around Range Bottom and Range Top in trend following markets or rejection in sideways markets. They offer less attractive R:R ratio as compared to "A Trades", but still have a high probability to succeed.

"C Trades": Breakout trades entered upon a breakout of Key Level 1↓ and Key Level 1↑ in trend following markets . They offer least attractive R:R ration, require a lot of trading experience and are seen as lowest probability trades.

Trading Long and Short

You can trade both long and short positions, particularly when the market is choppy or moving sideways, offering numerous entry points.

However, if a strong trend is established, it is crucial to avoid trading against the prevailing trend to minimize the risk of losses.

In a bullish trend, focus on buying during dips that respect the TradeLean Price Levels: Range Bottom and Key Level 1↓.

In a bearish trend, aim to sell from Range Top or better Key Level 1↑to align with the market direction

Situations to Avoid Trading

- Avoid trading in areas between two major TradeLean Levels (or zones) as these regions can be unpredictable and volatile. It is crucial to wait for clearer signals from well-defined zones.

- Refrain from trading before major news events, such as employment data releases, FOMC meetings, or central bank announcements, as these events can cause sudden and unpredictable market movements.

- Do not trade against a significant daily levels as these levels often represent strong support or resistance areas that can reverse the market direction.

- Avoid trading with large lot sizes after the first 3-4 hours of the New York session if the market has already moved substantially for the day, as this period often becomes calm and choppy.

- Stay away of trading during the daily, weekly and monthly opening and closing transition periods, as these times can be marked by low liquidity and erratic price movements.

Before Entering Trade

Trading Plan

Before opening a trade, you have to understand technicals in different timeframes - weekly, daily and intraday:

- Market structure

- TradeLean Price Levels (and confluences in different timeframes)

- Market sentiment

- Chart patterns (if applicable)

- Candlestick patterns

Here are practical steps how to work with TradeLean Strategy:

- Analyze technicals in the monthly chart.

- Analyze technicals in the weekly chart.

- Determine the technicals in the daily chart.

- Analyze intraday (1-Hour, 4-Hour) chart.

- Document the technicals for weekly, daily and intraday timeframes and document trade based on intraday chart.

- Determine if the price action is breaking out or rejecting the TradeLean Price Levels and analyze intraday candlesticks meticulously.

- Open a trade.

Trading Plan Example: EURUSD

Monthly Chart

Since the beginning of 2023, the EURUSD monthly chart is in sideways market, most of the time trading between Range Bottom t at 1.007 USD and Range Top at 1.107.

It has been periodically collecting liquidity below the Range Bottom zone.

However, being unable to sustain the price action below it, EURUSD reversed back into the TradeLean Range.

Euro is also presumably forming a Rectangle, which is a continuation chart pattern.

Weekly Chart

The current weekly candle is bearish, trying to push back into the TradeLean Range.

The sentiment in the weekly chart is bearish.

The weekly candle closure is important, as a closure below Range Top zone will push EUR price lower.

Upcoming week EURUSD can move in either direction and we can see some choppy sideways price action, however, more downside towards Range Bottom zone around $1.068 is very likely.

The Range Bottom zone coincides with multi-week ascending trendline which provides a confluence.

The price action with this zone will be very important.

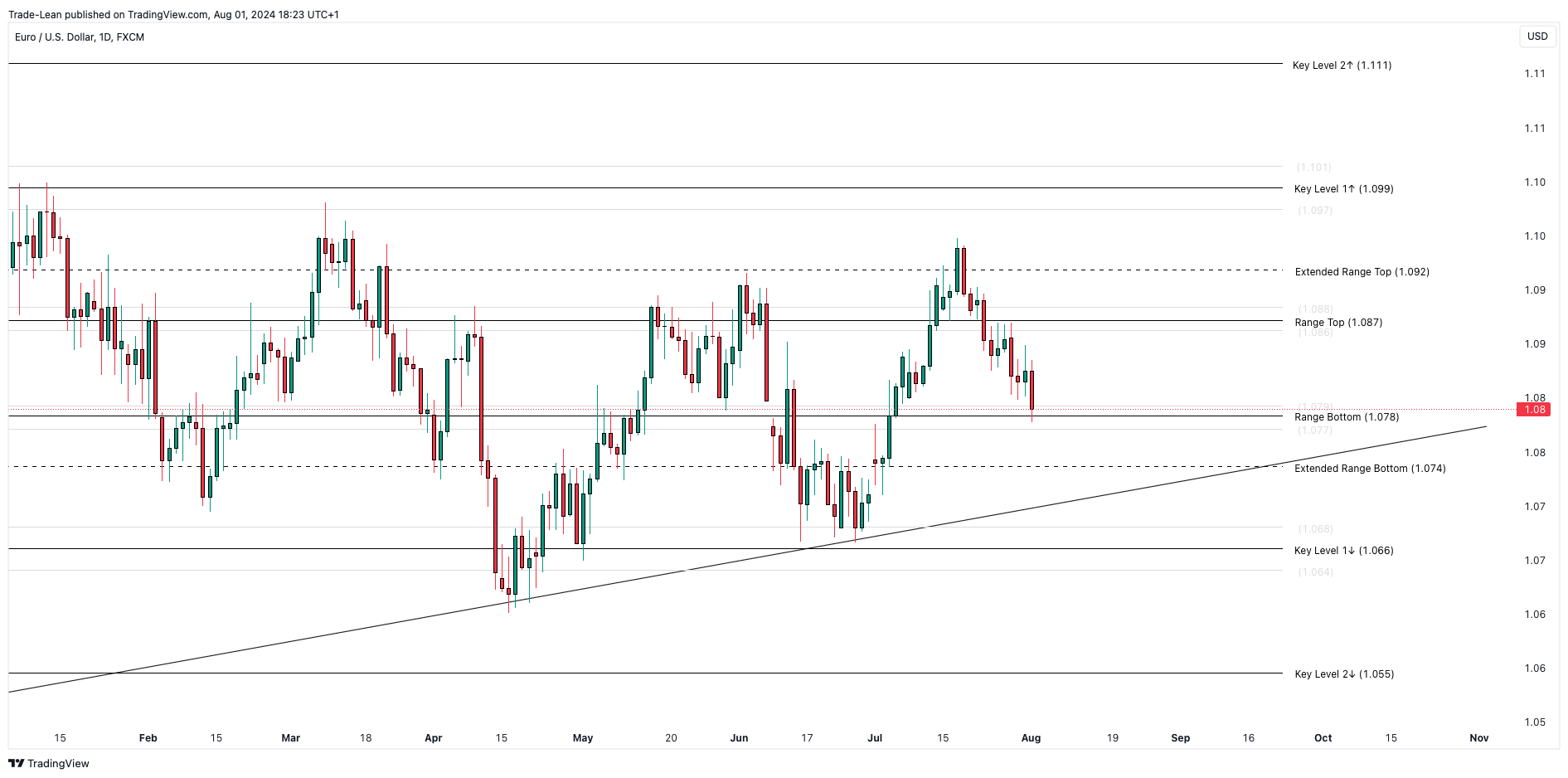

Daily Chart

The sentiment in the EURUSD daily chart is also bearish, with the current daily candle testing the Range Bottom zone.

The price action with Range Bottom zone is very important.

An inability to hold price above this Range Bottom price level will result in a further decline towards Extended Range Bottom level and, possibly, lower for re-test of the ascending weekly trendline.

Intraday Chart

The EURUSD intraday chart is very bearish as it is consolidating below Key Level 1↓.

A re-test of zone around Key Level 1↓ followed by a bearish rejection will lead to price moving towards Key Level 2↓ at $1.077 and, possibly, lower.

A bullish break-out of Key Level 1↓ at 1.081 will make Euro neutral and we are likely to see a slow, choppy price action towards $1.083.

A dip to Key Level 2↓ or even better to Key Level 3↓ and a bullish rejection of one of the levels will result in a long opportunity towards $1.085 and possibly higher.

Trade Setup

Long Entry: $1.072-$1.074 (Upon a bullish rejection of top of Key Level 3↓)

R:R Ratio: 3.54

SL: $1.069

B/E Move: When it moves close to TP2

TP 1: $1.077 (Close 30%)

TP 2: $1.081 (Close 25%)

TP 3: $1.085 (Close another 25%)

TP 4: $1.088 (Close remaining 20%)

Determining Position Size

Position sizing is a critical aspect of trading across all financial markets, including forex, cryptocurrencies, and stocks.

It involves determining the amount of capital to allocate to a trade, which directly influences risk management and potential profitability.

Here’s a comprehensive guide on how to determine the ideal position size for different financial markets.

Forex Trading Position Sizing

1. Identify Stop-Loss Levels: To determine your position size in forex trading, start by identifying where to place your stop loss. TradeLean Price Levels are reference for stop loss. Measure the distance between the entry price and the stop loss to understand the amount of risk per trade. If the stop loss is close to the entry price, a larger position size can be taken. Conversely, if the stop loss is far from the entry price, a smaller position size is advisable to account for higher volatility.

2. Define Risk Tolerance: Risk tolerance refers to the maximum amount of money you are willing to risk on a single trade. It’s commonly expressed as a percentage of your total account balance. For instance, if you have a $1,000 account, you should not be risking more than 1% per trade, your risk tolerance is $10. This helps in maintaining a disciplined approach and prevents significant losses.

3. Calculate Lot Size and Pip Value: In forex, lot size refers to the number of currency units traded, while pip value indicates the smallest price movement in a currency pair. To calculate your position size, divide your risk tolerance by the pip value. For example, if your risk tolerance is $10 and the pip value is $1, you can trade one mini lot. This ensures that your risk per pip remains manageable.

4. Set a Risk Limit Per Trade: Establishing a risk limit per trade is essential for effective risk management. For example, with a $1,000 account, you might set a risk limit of 0.5% or 1%, equating to $5 or $10 per trade. This fixed risk limit helps maintain consistency and prevents overexposure to market fluctuations.

5. Determine Position Size Using a Formula: Pip value×Pips at risk×Total lots traded=Amount at risk. For instance, if you have a $1,000 account with a 1% risk limit and are risking 10 pips per trade with a pip value of $1, you would trade one mini lot, or 10,000 units of the currency pair.

Crypto Trading Position Sizing

1. Assess Market Volatility: Cryptocurrencies can be highly volatile, so setting appropriate stop-loss levels is crucial. Use volatility indicators or historical price movements to determine these levels. Larger percentages might be necessary due to the high volatility of the crypto market.

2. Define Risk Tolerance: As with forex, define your risk tolerance as a percentage of your total account balance. For example, with a $5,000 account and a 1% risk tolerance, you are willing to risk $50 per trade.

3. Calculate Position Size: In crypto trading, calculate your position size by dividing your risk amount by the distance to your stop-loss. For instance, if you’re willing to risk $50 and your entry and stop-loss levels are $500 apart on Bitcoin, you might purchase 0.1 BTC to stay within your risk tolerance.

Stock Trading Position Sizing

1. Identify Entry and Stop-Loss Levels: Determine your entry point and stop-loss levels based on technical analysis or fundamental factors. The distance between these levels will help gauge the amount of risk per trade.

2. Define Risk Tolerance: Set your risk tolerance as a percentage of your account balance. For instance, with a $10,000 account and a 1% risk tolerance, you’re willing to risk $100 per trade.

3. Calculate Share Quantity: Calculate the number of shares to trade by dividing your risk tolerance by the difference between the entry price and the stop-loss. For example, if you’re willing to risk $100 and the difference between your entry and stop-loss is $2, you would trade 50 shares ($100 / $2).

Determining the ideal position size in forex, crypto and stock etc is essential for managing risk and enhancing potential returns.

By carefully assessing stop-loss levels, defining risk tolerance, and calculating the appropriate position size, traders can create a balanced and disciplined trading approach.

Entering with Partial Position

Entering a trade with a partial position when the price moves against you can be a strategic approach to managing risk and optimizing potential returns.

This method involves entering a trade with a smaller initial size (30-50% of their intended position) and adding to the position if the market moves unfavorably, thereby averaging down the entry price and reducing the overall cost basis.

The Initial Entry with a Partial Position

The concept of entering a trade with a partial position is closely tied to a probability-based mindset, acknowledging that market movements are inherently unpredictable and that an initial trade might not always go as planned.

By committing only a portion of the intended investment at the outset, traders maintain flexibility and limit their exposure to immediate risk.

This initial entry should still be based on a solid technical setup, ensuring that even a partial position has a favorable risk-to-reward ratio.

For instance, if a trader identifies a potential breakout level using the TradeLean Price Levels, they might enter the trade with 30-50% of their intended position size.

This cautious approach allows the trader to gauge the market's reaction to the breakout level without committing too much capital.

If the price moves in their favor, the trader can continue to manage the position with trailing stops or predetermined profit targets.

Risk Management Considerations

While entering with a partial position can be effective, it is crucial to have a well-defined risk management plan.

Traders should determine the maximum amount of capital they are willing to allocate to a single trade and stick to this limit to avoid overexposure.

Additionally, setting stop-loss orders for each tranche of the position can help manage risk if the market continues to move unfavorably.

It is also important to analyze market conditions and ensure that additional entries are made at strategic levels, such as Key Level 1↓ or Key Level 1↑ identified through the TradeLean Strategy.

Blindly adding to a losing position without technical justification can lead to significant losses.

Therefore, traders should combine entry with partial positions with thorough technical analysis and market understanding.

Psychological Benefits

Using a partial position entry and DCA can also provide psychological benefits by reducing the stress associated with market volatility.

Knowing that there is flexibility to manage and adjust the position can help traders remain calm and make rational decisions, rather than reacting emotionally to market movements.

Exiting Trade

Closing Positions

The most critical aspect is how and when to close your positions, as this can significantly impact your overall profitability.

If you are trading a large lot size, "B Trade", "C Trade" and the market starts showing opposite signals, it is essential to exit the trade immediately to avoid substantial losses.

Close the trade if the market turns against you, and you see two consecutive opposing candle closings, following predefined signals for exiting based on candlestick patterns to protect your capital.

Partial Closing

Taking partial profits or losses is essential, especially if the trade reaches the next TradeLean Price Level, which often indicates a potential reversal or significant support/resistance level.

To take partial profits, we often use Minor Levels in the intraday chart when scalping with leverage and Minor Levels in the daily chart when trading spot positions.

If unsure about partial closing strategies, it's beneficial to seek further education or guidance to enhance your trading skills.

Securing Profits

To secure a running trade in profit, partially close the position and move the stop loss to the entry price, ensuring you lock in some gains while still allowing the trade to run.

It is crucial not to move the stop loss prematurely, as this can limit your profit potential.

Using Stop Losses

Always use a stop loss if you have less than five years of trading experience, as this is a fundamental risk management tool that can prevent significant losses.

Experienced traders might adjust their strategy based on market conditions, but a stop loss is recommended in all cases except long-term hold positions.

Consistently using stop losses helps maintain discipline and protects your trading capital from unexpected market movements.

Closing Trades Early

Close the trade if the next TradeLean lines are close and a counter pattern forms in a slow market, as this can indicate a potential reversal against your position.

If an intraday trade does not reach the target within 12-24 hours, it is wise to close it to avoid unnecessary risk exposure.

If uncertain news or events occur, close the trade or adjust the stop loss to break even to protect your capital and mitigate potential losses.

Lastly, if you observe a false breakout, it is crucial to close the trade or at least half of it to minimize losses.

Being proactive in managing your trades can prevent significant losses and help you maintain a positive trading performance.

Consistently applying these principles will enhance your trading strategy and improve your overall results.

Summary

Mastering the art of trading involves a blend of strategic timing, precise trade execution, and rigorous risk management that we will in detail discuss in the next section.

Adhering to the TradeLean Strategy can significantly enhance your trading performance by focusing on high-probability trade setups and disciplined position sizing.

Always remain vigilant during key market sessions and avoid trading in unpredictable zones to minimize risks.

Continual learning and adapting to market changes are essential for long-term success.

By consistently applying these principles, traders can navigate the complexities of the market and achieve sustained profitability.