Final Words

Bringing everything together!

As we reach the culmination of the TradeLean Strategy Guide, it's essential to reflect on the journey we've undertaken together.

The world of trading is vast and complex, filled with its own unique language, challenges, and opportunities.

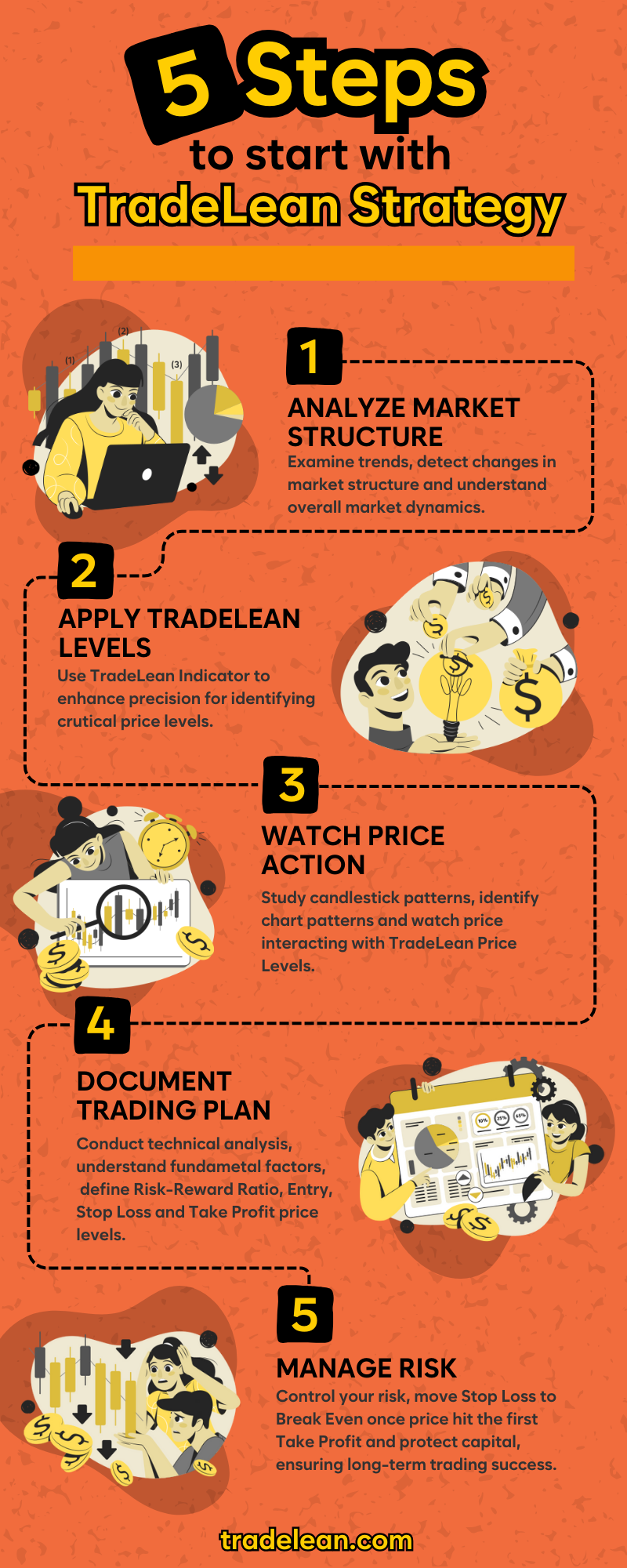

Through understanding market structure, mastering price levels, reading price from candlesticks, and demystifying chart patterns, we've navigated the core components that form the backbone of the TradeLean Strategy.

Trading is not merely a technical endeavor; it is profoundly personal.

It involves not just the mind but the heart.

Every trader, whether novice or experienced, embarks on this journey with dreams and aspirations.

Some seek financial freedom, others the thrill of the markets, and many the intellectual challenge it presents.

This guide has aimed to equip you with the knowledge and tools needed to face these markets with confidence and poise.

And it is absolutely FREE!

One of the foundational aspects we explored was the importance of understanding market structure.

Recognizing the underlying patterns and trends within the market is akin to learning the grammar of a new language.

It allows you to interpret the story the market is telling, to anticipate its next moves, and to respond accordingly.

By mastering this skill, you set the stage for more strategic trading decisions.

Mastering price levels was another crucial element we delved into.

Price levels are not just numbers on a chart; they represent significant psychological barriers and milestones within the market.

Understanding how to identify and react to these levels enables you to make more precise and impactful trades.

It's about seeing beyond the immediate price action and recognizing the deeper currents that drive market movements.

Candlestick reading was another essential skill we covered.

Each candlestick on a chart tells a story of market sentiment, the battle between bulls and bears, and the psychology of traders.

By learning to read these candlesticks, you gain insight into the market's emotional state and can make more nuanced and informed trading decisions.

Chart patterns, often viewed with skepticism by some, were demystified to show their practical applications.

These patterns are the footprints of market psychology, providing signals and clues about future price movements.

By integrating these patterns into your trading strategy, you enhance your ability to predict and capitalize on market trends.

Explaining TradeLean Price Levels and unlocking the TradeLean Strategy were pivotal parts of this guide.

The TradeLean Strategy is not just a set of rules; it's a philosophy of trading that emphasizes discipline, patience, and continuous learning.

It is about finding a balance between risk and reward, making smart decisions, and staying adaptable in the ever-changing market landscape.

Integrating market structure and price action into TradeLean Strategy was emphasized to create a cohesive and effective trading approach.

This integration is about harmonizing different aspects of market analysis to form a holistic view.

It is this comprehensive perspective that allows for more strategic and successful trading.

Showcasing the TradeLean Strategy in action provided practical examples of how theory translates into practice.

Seeing real-world applications of the strategies and techniques discussed helps solidify your understanding and gives you a roadmap for implementing them in your own trading.

Developing a probability thinking mindset is essential for any trader.

Trading is inherently uncertain, and adopting a mindset that embraces probability and risk management is crucial.

It's about understanding that no single trade defines your success, but rather the cumulative outcome of many trades.

Optimizing entry and exit points is another critical skill we focused on.

Timing your trades effectively can significantly impact your overall profitability.

By refining your entry and exit strategies, you enhance your ability to capture more significant gains while minimizing losses.

Managing risk, perhaps the most vital aspect of trading, was thoroughly examined.

Risk management is not just about protecting your capital; it's about ensuring your longevity in the market. It's about making strategic decisions that balance potential rewards with acceptable levels of risk.

Embracing continuous improvement is the final cornerstone of the TradeLean philosophy.

The markets are constantly evolving, and so too must your strategies and skills. Continuous learning and adaptation are essential for long-term success in trading.

As you move forward, remember that the path of a trader is not a straight line but a journey filled with ups and downs.

There will be moments of triumph and times of challenge.

What will define your success is not just your technical knowledge but your resilience, discipline, and willingness to learn from every experience.

Thank you for embarking on this journey with the TradeLean Strategy Guide.

May your trading be informed, strategic, and prosperous.

Keep learning, stay disciplined, and embrace the ever-evolving world of trading with confidence and passion.

The markets await your unique approach and perspective.

Happy trading!